Iran’s Venture Capital Market Surges Fivefold in 2024, Led by Digikala and Cafe Bazaar Deals

Venture capital funding in Iran increased fivefold in 2024 with significant investments in Digikala and Cafe Bazaar.

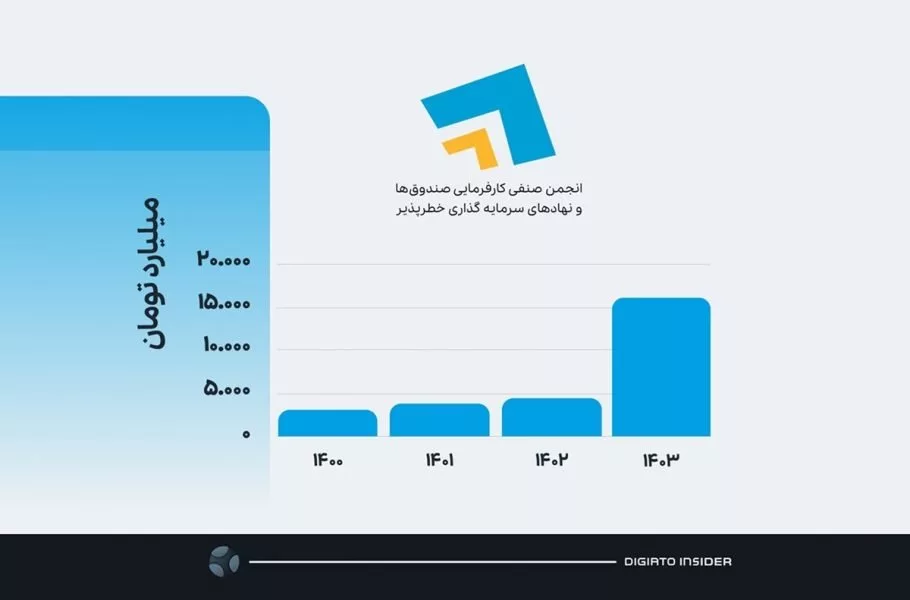

Venture capital investments in Iran saw a fivefold increase in 2024, driven largely by major share acquisitions in Digikala and Cafe Bazaar. According to Abbasali Karshenas, Secretary of the Venture Capital Association, the total volume of venture capital contracts reached approximately 16.17 trillion tomans last year. Nearly half of this figure is attributed to significant investments made in these two tech companies.

During a press briefing held on Tuesday, October 6, titled 'Financial Report of the Technology and Innovation Ecosystem for 2024,' Karshenas presented key findings from the association’s annual report, which is set for full release on October 13. He noted that two-thirds of the total investment volume stemmed from direct equity purchases.

Responding to a question about the drivers behind this surge, Karshenas highlighted two major deals involving Hamrah Aval and Tapcell, which acquired shares in Digikala and Cafe Bazaar. These transactions alone accounted for roughly 7 trillion tomans in investments last year. Even excluding these deals, venture capital investment still doubled compared to the previous year.

The Venture Capital Association comprises 164 members, including research and technology funds, corporate venture funds, stock market-based venture funds, innovation finance firms, valuation companies, and innovation accelerators. Collectively, these members hold registered capital exceeding 17 trillion tomans.

Karshenas also announced updates to this year's report, including new sections on services provided by financial institutions to knowledge-based companies. Previously focused on investment, loans, and guarantees, the report now incorporates valuation services and crowdfunding platforms as well.

Crowdfunding platforms raised an impressive 12.86 trillion tomans in 2024, three times higher than all amounts collected in previous years combined.