An Analysis of Donseh Hotel Group’s Evaluation Report: Costly Financing for a Low-Margin Business

Donseh Hotel Group sees revenue growth but struggles with costly financing and low-profit margins.

The evaluation report of Donseh Hotel Group reveals significant revenue growth for the company, accompanied by a proportional increase in expenses. A concerning aspect of this business is the persistent imbalance, where costs consistently outweigh assets.

The company entered the tourism sector in 2020. Nima Qazi, co-founder and a major shareholder, is also known for co-founding Alibaba Group. For several years, Qazi has been focused on the Donseh Hotels project alongside his partner Soheil Mamdouhi.

Recently, Donseh Hotel Group launched a new financing initiative through a crowdfunding platform. In line with this effort, an evaluation report was published by Etemadsazan Group based on the company’s audited financial statements.

In 2024, Donseh reported a net profit of 9 billion tomans but also disclosed approximately 14.5 billion tomans in deferred expenses. It remains unclear which of Donseh's expenditures have been capitalized. Furthermore, one of the primary risks facing the group is its low business margin despite heavy financial backing. Given that revenue and expenses are growing concurrently, scaling operations may not necessarily improve profitability margins.

Financial Performance Overview

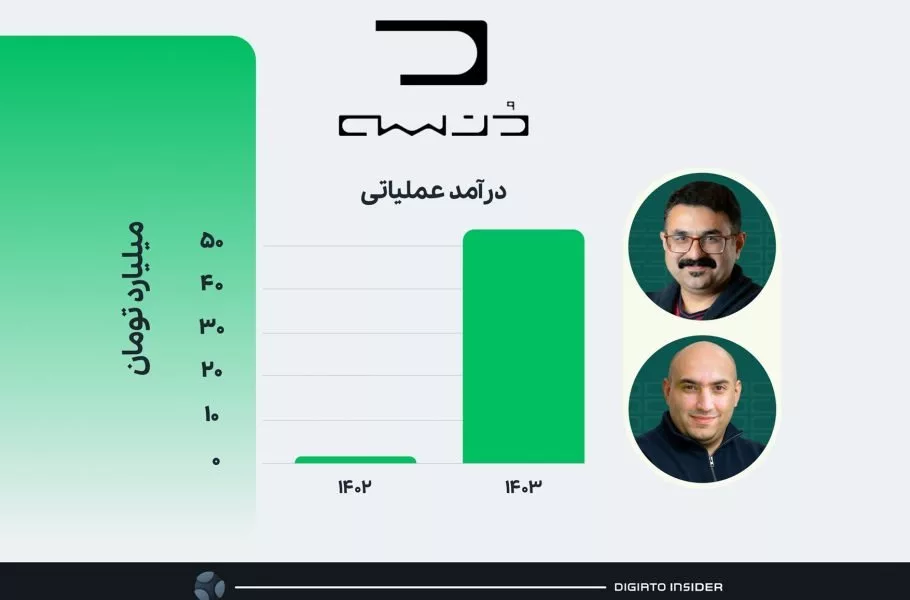

Donseh’s operational income primarily stems from room rentals and services provided to hotel guests. Revenue has shown an upward trajectory, rising from 1 billion tomans in 2023 to over 52 billion tomans in 2024. Nearly three-quarters of this revenue originates from 'Hotel Gilarya' located in Kiashahr, a property with a longer operational history compared to other hotels within the group.

However, alongside growth in revenue and assets, Donseh’s liabilities have surged significantly. According to Etemadsazan Group’s assessment, the company's current liabilities exceed its current assets, resulting in negative working capital and indicating liquidity pressures in meeting short-term obligations.